The last couple of years have created great opportunities for futures traders. The limiting factor for us has always been the amount of capital we have available to trade and the fear of loss of that capital if we trade lots of contracts.

Top Step Traders started a new industry - the commercialization of funding futures traders. Initially it seemed that the industry was purely designed to profit from futures traders buying the right to prove they were consistently profitable and then failing and paying to try again. That seems to have changed.

After Top Step we had LeeLoo Trading and more commercialization. The next iteration of trader funding companies was Apex Trader Funding. Apex came to the scene after Darrel Martin, the owner of Apex Investing, became dissatisfied with the rules of LeeLoo Trading who he was using for himself.

The by-product of Apex entering the trader funding business was the crushing of the fees charged for a trader buying the right to prove he was consistently profitable. A plethora of other companies entered the business. I understand that using any of these companies has some risk to the trader. We rely on them wanting and being able to pay our profit share after we have qualifies for an account that promises to give us a share of the profits. For this reason, choosing which trader funding company to go with requires some investigation and due diligence. But even after that we do have some risk of not getting our profit share at some time in the futures even when the funding company has the best of intentions. This is a business risk for us.

Having said that, being able to trade size and only risking a relatively small amount to buy the eval account is a winning deal for us.

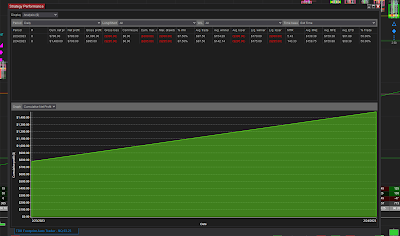

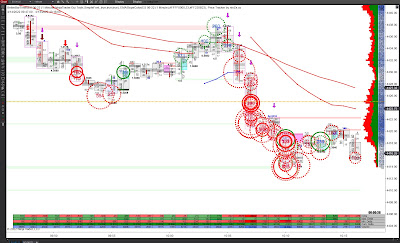

So, make a plan. The chart below is one such plan. It uses order flow for entries and has back tested to take profit at 30 ticks in NQ with a stop loss of 45 ticks. The plan calls for stopping trading at a profit of $300 per contract per day and a stop loss of $1,000 per day. These numbers were the result of back testing the plan so the draw down rules of the funding company were not likely to be breached. Remember, every time you put on a trade you are taking on risk.

The other part of the plan was to open 20 separate accounts with the trader funding company but to only trade about one third of them on any one day so that in the event of catastrophe you are still in the game. As you can see from the chart and pic below There was a profit of about $300 on each of 7 accounts. This is the goal of the plan for each day. As you can also see, there were just 2 trades that happened to be between 88pm and 8.30pm Chicago time and the day was done. With the growth of stock index trading to the Asian time zone it is possible to trade any time zone and still keep a day job until you are ready to go full time.

As you know, waiting for the right setup can sometimes take a while. Using one of the automation tools such as Shark Indicators Bloodhound and Blackbird can ensure that when that setup occurs you do not miss it. This is what I do.